Today I want to talk about Ssense, the Canadian retailer that, for years, was the one-stop shop for designer fashion. Heritage houses, cult names, even the newest label you’d just seen on Instagram the week before, it was all there. At its peak, Ssense felt like the entire fashion ecosystem under one roof. And honestly, everyone I know in fashion shopped there at some point.

But now, that empire has cracked. In 2025, Ssense filed for bankruptcy protection, undone by a perfect storm of tariffs, collapsing U.S. sales, and years of teaching their customers to never pay full price.

And here’s the truth: Ssense didn’t collapse overnight. It wasn’t one sudden blow. It was a slow erosion from within. Because for all the prestige, for all the curation, what Ssense was really known for… was its sales.

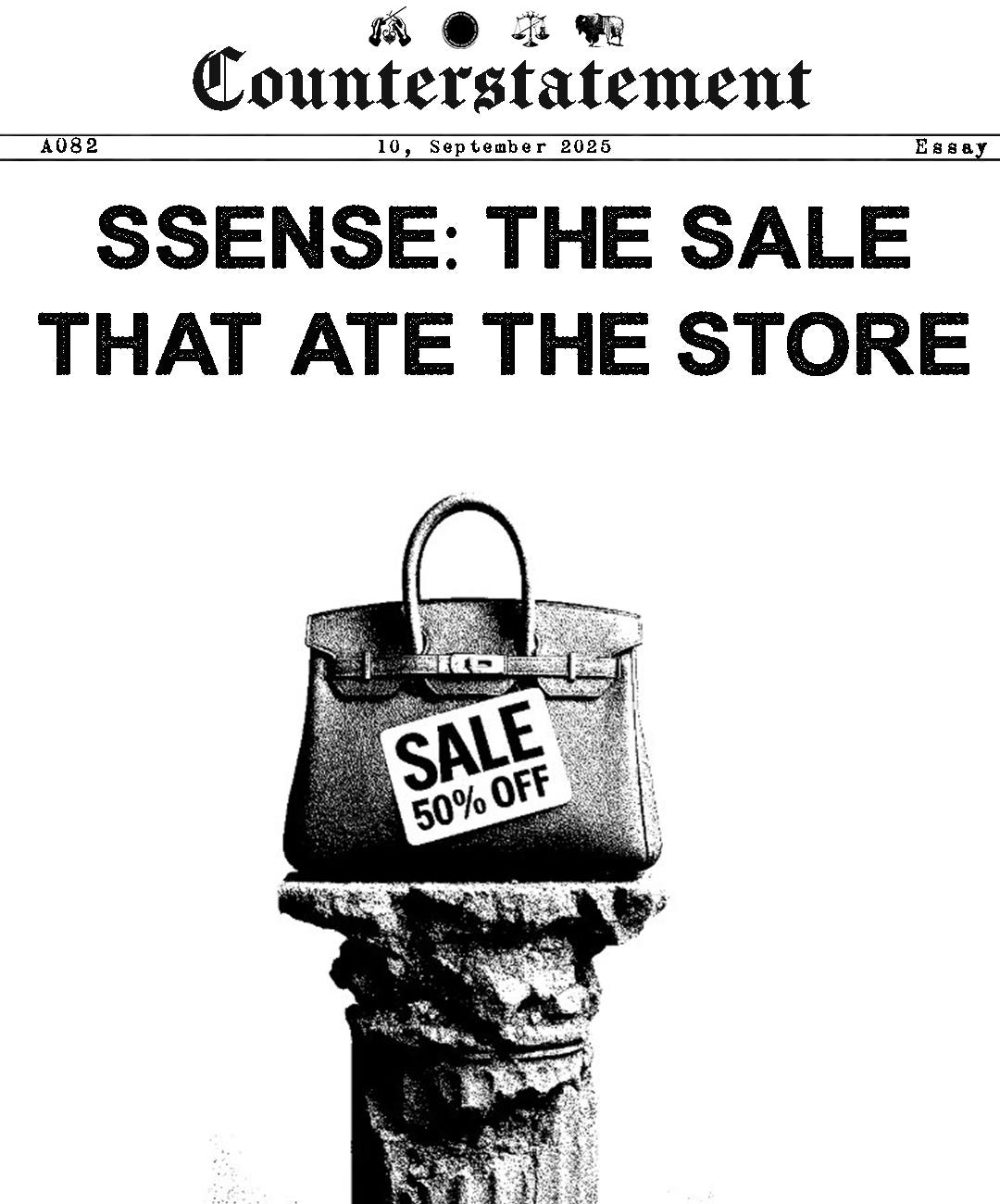

1. Discounts Destroy Myth

Luxury doesn’t live in price alone, it lives in distance. It lives in the feeling that a garment is just out of reach, that access must be earned, that the object carries a myth larger than its material form. Scarcity and ritual are what sustain that distance.

Ssense’s endless sales dismantled that scaffolding. When you train your audience to expect 40, 50, even 70% markdowns, you collapse the aura entirely. The garment is no longer a sacred object of desire, it becomes just another commodity waiting for its clearance tag. The myth evaporates the moment the customer realizes the brand doesn’t even believe in its own value.

And here’s the deeper damage: customer conditioning. Over time, Ssense’s audience learned not to buy full price, no matter how much they wanted something. Why pay $900 today when history shows it will be $450 next month, or $300 if you’re patient? What began as a clever way to clear stock became a Pavlovian bell. Customers were rewarded for waiting, so they waited.

This is the cruel irony: Ssense, in trying to drive short-term sales, taught its own community to devalue not only the products it carried but the very notion of luxury itself. The audience wasn’t loyal to Ssense, they were loyal to the sale. Once conditioned, that mindset is almost impossible to reverse.

In luxury, discipline is everything. Protecting price protects myth. The moment you break that covenant, you can’t ask customers to believe again.

2. Margins Bled Dry

The math of retail is unforgiving. Most fashion retailers buy wholesale at roughly 50% off retail price. On paper, that looks like a healthy spread. But by the time you layer on the real costs, shipping, warehousing, staff salaries, credit card fees, customer service, returns, and marketing spend, that margin shrinks dramatically. In the best of times, you’re left with something fragile, a narrow strip of profitability that relies on volume and efficiency to survive.

Now add Ssense’s permanent discount culture. That 50% spread isn’t a cushion anymore, it collapses under the weight of markdowns. A jacket wholesaled for $500 and listed at $1,000 looks viable. Sell it at 40% off, though, and suddenly you’re pulling in $600 on a $500 cost before any overhead. Add shipping, returns, and advertising, and you’re likely selling at a loss.

For a while, this didn’t matter. Capital was cheap, consumer demand was hot, and global shipping was relatively frictionless. In those “fat years,” the perma-sale model could limp along. But the margins were already paper thin, and paper burns quickly when crisis strikes.

The moment external shocks hit, U.S. tariffs, the end of duty-free imports under $800, supply chain snarls, inflation-driven cost spikes, Ssense had no buffer. They couldn’t pass costs onto customers, because they had trained their audience to wait for discounts. They couldn’t absorb the hit, because margins had already been bled dry long before the crisis.

This is the peril of building on perpetual discounting: you don’t just compress your margins, you erase your safety net. When the storm comes, there is nothing left to absorb the blow. And in fashion, storms always come.

3. Short-Term Growth Addiction

Sales are sugar. They hit fast, they feel good, they make the numbers look strong. Traffic surges, engagement spikes, product clears. The dopamine loop runs not just for the company but for the customer too: Ssense drops a sale, the customer hunts, clicks, scores, and brags. Both sides get their hit.

But like sugar, the crash always follows. By leaning on sales to drive growth, Ssense mortgaged the future for the present. They never weaned their audience off that high, never taught them to value the product at full price, never built the kind of long-term loyalty that could sustain the brand when markets tightened.

Instead of cultivating a community of believers, customers who buy into philosophy, myth, and aura, they bred discount hunters. People trained to game the system. For this audience, Ssense wasn’t a cultural destination, it was an outlet mall with better styling.

And here’s the catch: discount hunters are the most fickle community of all. They’re not loyal to brand or retailer, they’re loyal to the deal. When the deal dries up, they vanish overnight. Which is exactly what happened when tariffs drove up costs, margins disappeared, and Ssense could no longer float the perpetual markdowns.

This is the deeper failure of short-termism: the audience you think you’re growing isn’t an audience at all, it’s a feeding frenzy. The moment the feeding stops, the crowd disperses.

4. Strained Brand Relationships

Independent designers often loved Ssense because it gave them global exposure they couldn’t get elsewhere. A young label could appear next to established houses and instantly gain legitimacy. For small brands, Ssense was a launchpad.

But for the larger luxury houses, it was a thorn. Seeing their products perpetually slashed in price sent a damaging message. Chronic markdowns do more than move inventory, they chip away at the symbolic value of the brand itself. Luxury thrives on discipline, on a carefully guarded aura where prices are as rigid as the myth.

When a $2,000 jacket is consistently available for $1,000, the illusion fractures. The full-price customer feels like a fool, the aspirational customer learns to wait, and the brand looks cheapened by association. Over time, this undermines trust. Big houses do not want their aura diluted by a retailer that teaches customers their products are disposable.

The consequences are subtle but devastating. Brands begin restricting what they ship, withholding the strongest pieces, or refusing to renew wholesale contracts altogether. A retailer known for endless sales stops being seen as a luxury platform and starts looking like a liquidation pipeline dressed up in nice photography. Once you lose access to the best product, you lose your ability to play gatekeeper. And without gatekeeping, you lose cultural authority.

5. No Cushion for Crisis

By the time the U.S. eliminated duty-free imports under $800 and piled on steep tariffs, Ssense had no margin buffer left to absorb the shock. Years of discount culture had already eroded their ability to protect profitability. When costs ballooned, there was nowhere to hide.

Sales collapsed in the U.S., their largest market, and the perma-sale conditioning meant there was no path to retrain customers to pay full price. A culture of waiting had become embedded in the psychology of their audience. They had built loyalty not to the brand, but to the markdown. And loyalty to markdowns is the most fragile loyalty of all.

The moment Ssense could not afford to keep discounting at the same pace, they lost the very behavior they had spent a decade teaching customers. This is the fatal trap of short-termism: you condition your audience into habits you cannot sustain. When the discount pipeline dries up, the community disperses.

In that context, tariffs were not just an external blow, they were the stress test that revealed the underlying weakness. Healthy margins could have absorbed the shock. A disciplined pricing culture could have given them leverage to adjust. Instead, with no safety net, the crash was inevitable.

The Lesson

Ssense didn’t die because of one policy change. The tariffs were the final hammer, but the cracks were structural, woven into the DNA of their model. When you build your reputation on discounting, you’re not just moving inventory, you’re creating a culture. You’re teaching your customers, over and over again, that the real price is never the listed one, that patience will always be rewarded with a markdown, that value is negotiable.

And once that lesson sinks in, it’s almost impossible to unteach. This is the negative conditioning that kills luxury: the audience stops believing in the aura of the product and starts believing in the inevitability of the sale. They no longer see a rare object of desire, they see a future clearance tag.

Scarcity, on the other hand, is the oxygen of aspiration. It’s what makes people climb, what makes a bag or jacket feel larger than fabric, what turns a garment into a symbol. Scarcity isn’t just withholding product, it’s protecting aura, holding the line so that customers never doubt your belief in your own value.

The fast spike of traffic from a sale feels intoxicating, but it’s a sugar rush. The long game is belief, trust, and myth. Aura outlives algorithms. Scarcity creates gravity. And the fastest way to lose both is to collapse your brand into a perpetual clearance rack, where the very act of waiting becomes the culture you’ve built.

The lesson for founders is brutal but clear: every sale teaches your audience something about you. Teach them discipline, mystique, and aspiration, and they’ll believe. Teach them that everything will end up 70% off, and they’ll wait. One path builds a cult, the other builds a liquidation pipeline.